A Century of Tariffs: A Historical Perspective

Tariffs have long been a tool of U.S. trade policy, often with profound consequences for agriculture. Over the past 100 years, trade wars sparked by tariffs have disrupted markets, altered supply chains, and reshaped the fortunes of farmers. Below, we summarize the major tariff-related trade conflicts since 1925, focusing on their impact on corn and soybean farmers, as well as broader agricultural trade.

Smoot-Hawley Tariff Act (1930–1934)

Probably one of the more famous trade Acts, the Smoot-Hawley Tariff Act of the 1930s raised tariffs on over 20,000 different imported goods to an average of 60%. Enacted to save farmers from the onslaught of the Great Depression, it had adverse affects starting a global trade war. European countries retaliated with tariffs of their own causing a sharp decline in U.S. farm exports. Farm balance sheets heavily suffered as American farmers had record surpluses, and farm bankruptcies skyrocketed. Government intervention happened in late 1933 but the damage to farmers had been done already.

The “Chicken War” (1962–1964)

Placed on U.S. poultry imports by European countries in the 1960s, U.S consumers became reliant homegrown broilers. America fought back with retaliatory tariffs on automobiles but U.S. Farmers still were still shook with surpluses lowering chicken prices, and a noticeable impact on row crop production. Negotiations settled this tariff war, but the fragility of the system began to show.

U.S.–Japan Trade Friction (1980s)

Trade imbalances of electronics and automobiles with Japan in the late 1980s began to show how sectors outside of Agriculture could still affect American beef and grain exporting. U.S. negotiations led to higher beef exports and American farmers made out pretty well as Japan was a huge buyer of feed grains.

The “Pasta War” (1985)

A small 9 month dispute between the U.S and Europe yet again in 1985 led to the U.S. imposing tariffs on Pasta, and Europe retaliating against Walnuts and Lemons. American grain and livestock farmers were relatively unaffected, but the vulnerability of the system was yet again apparent

Beef Hormone Dispute (1989–2009)

In 1989 the European Union came out to say they would no longer accept U.S. hormone treated beef, leading to a twenty year dispute and trade war. Beef exports to Europe suffered dramatically, but corn and soy farmers were generally unaffected as feed grains remained stable. In 2009 the European Union ended their hormone ban, but the complexity of health related tariffs was apparent.

Softwood Lumber Disputes (1982–Present)

By measure one of the longest tariffs in history, the U.S. - Canadian lumber trade has seen disputes for over 40 years. While U.S. farmers haven’t necessarily seen any implications through exports, the cost of building new infrastructure has been affected, and there is no end in sight, as Canada holds #2 in the list of global lumber producers.

Banana Trade War (1993–2012)

In 1993 the European Union yet again enacted tariffs, this time on the U.S. and Latin American Banana producers. Retaliation meant American tariffs on European luxury goods. Resolved in 2012, American ranchers and row crop farmers were mostly unaffected, however showed again how agriculture could be roped into unrelated trade wars.

Steel Tariff War (2002–2003)

In 2002, the U.S. got into another short trade war with the European Union. With 8-30% tariffs on all American imports, the EU retaliated with threats to tariff American citrus production. Florida’s orange production, a cornerstone of the southeastern economy, was very vulnerable and led to quick mediation.

U.S.–China Tire and Chicken Dispute (2009)

Tires and Chickens were the topic of a 2009 trade battle that lasted 9 years. U.S. acted as the aggressor as President Obama enacted tariffs on Chinese tires, leading China to retaliate with tariffs of their own against poultry. American poultry producers suffered heavy losses, and some trickle-down affected grain producers as well. This conflict showed how willing China was to impose tariffs on America, even while relying on U.S. production.

Steel and Aluminum Tariffs (2018–2019)

With the 2018 American Steel and Aluminum tariffs of 25% and 10% respectively, retaliation from Canada, Mexico, and the European Union targeted U.S. pork, dairy and specialty crops. While grain farmers escaped direct tariffs, pork producers suffered very low margins. Resolved in 2019, the USDA approved aid payments to producers.

U.S.–China Trade War (2018–2020)

The most recent and top of mind trade negotiation happened in 2018, when tariffs from China caused a 53% drop in agricultural exports in corn and soybeans. Surplus crops drove prices even lower and soybean prices took major hits. Expect this scenario to be somewhat similar as we face uncertainty in 2025, with some soybean producers already in the red.

Our Take - Farmland Stock Exchange

While China remains our largest buyer of grains, the USDA is working to strengthen domestic supply chains, and create broader export markets. With the volatility of 2025 Agriculture tariffs, it is imperative as a producer to know your bottom line, and create on farm synergies when possible.

Land Ledger Podcast - Andes Bio

What if your soil could pay you back? In this episode of The Land Ledger, Brian Kearney talks with Stephen Lamb and Tony Feitz of Andes Ag about how the Andes carbon program is allowing farmers to earn $10/acre without changing the way they farm.

Listen in to learn who’s eligible for the Andes Carbon Program, how to get started, and why even skeptical farmers should take a second look. You’ll hear about the benefits of using microbes to capture carbon and the financial benefits for farmers, the role of supply and demand in carbon markets, and the big potential here for revenue—without sacrificing yield.

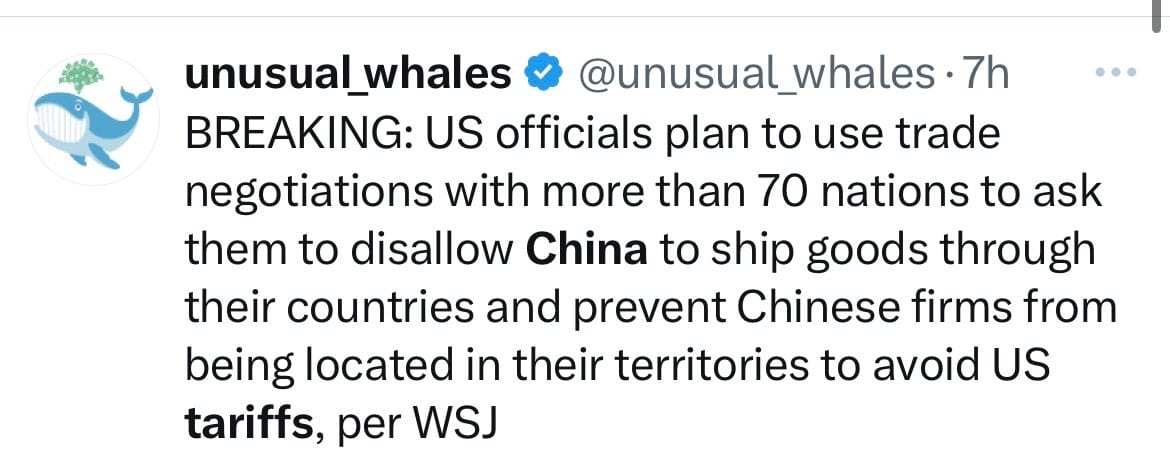

Heard on X