What is a Fair Price?

For the nearly 45% of American farmers that lease ground, the question above probably crosses their mind every winter. What is a fair price to rent ground? While there are many different ways to approach leasing, such as crop shares, and flex leases, cash renting takes the crown. Built on relationships between Farmer and Landlord, over 280 million acres are cash rented annually. But what does this mean for Farmers?

In the Midwest, the average cash rent expense is between 25-40% of the gross income per acre, a significant expense each year. For example, in Illinois rented ground makes up 30-60% of farm income each year. Speaking economically many farms cannot survive without renting ground, all in a competitive marketplace, where their neighbors are likely interested in renting ground out from under them.

In addition, many landlords charge rent to their tenants on March 1st, after farmers have received all of their income from the previous year’s crop. While dates can be negotiated differently for each farm, many Farmers use operating loans to fund their rent expense. Based on conversations with lenders and farmers, at the time of writing, operating loans range from 6-10% interest rates. As any farmer knows, even with the rise of favorable crop insurance policies, they are betting on a good crop 8 months before it’s even harvested.

For many farmers, it’s common to dread negotiations each winter, as the average cash correlates to land prices. From 2023-2024 the U.S. average cash rent rose 3.2% according to the American Farm Bureau Federation.

Is There a Solution?

So is there a solution that allows farmers to retain acres without gambling and losing bottom-line profit to interest? At Farmland Stock Exchange we think so. All of our farms are operated on a 67/33 crop share. While it could be difficult to convince a landowner to move to a crop share for several reasons including a fixed revenue stream, reduced risk, simplicity, and flexibility, it is estimated that around $2-4 Billion a year is put toward servicing interest on cash rent operating loans, a staggering amount that could be money in farmers pockets.

While every farm needs to do what is best for their profitability, now is the perfect time to be having conversations with landlords. To show a landowner what they could do to better support a farming operation its best to provide full financial reviews. This could include a big-picture view such as reports made with Ag View Solutions, Croptell, Ambrook, or Traction Ag that provide transparency on input costs, crop plans, and grain marketing. When farmers can show how their decision-making can generate revenue for both parties it makes it much easier to have difficult conversations.

Our “why”

At Farmland Stock Exchange, we do not want to create tenant farmers. To address the estimated 70% of farmland changing hands in the next 5-10 years, the largest generational wealth transfer of any generation, we think it is imperative farmers have equity, and remain in control of the ground they farm.

Check out our website www.farmlandstocks.com or check out the Land Ledger podcast to hear more about our mission of helping farmers.

Heard on X

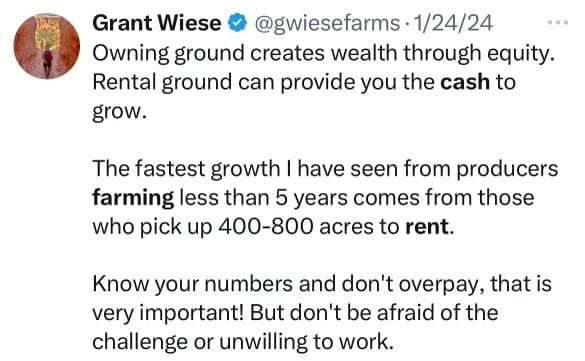

This graph is an excellent example of the volatility cash rents can have on a farming operator. When it comes to negotiating every year, farmers make decisions that can significantly impact the future of their operations. With a fixed percentage crop share, they are able to better withstand commodity downturns and times of high input costs.

Grant’s best advice from above is to know your costs. Whatever process you use to measure profitability, it is important to share this information with landlords. With a better understanding of the financials of your operation, it makes it easier to have difficult conversations.