Welcome to the May 2025 Midwest Planting Progress Newsletter, delivering the latest updates on corn and soybean planting across the region, alongside critical drought insights.

Corn Planting Progress

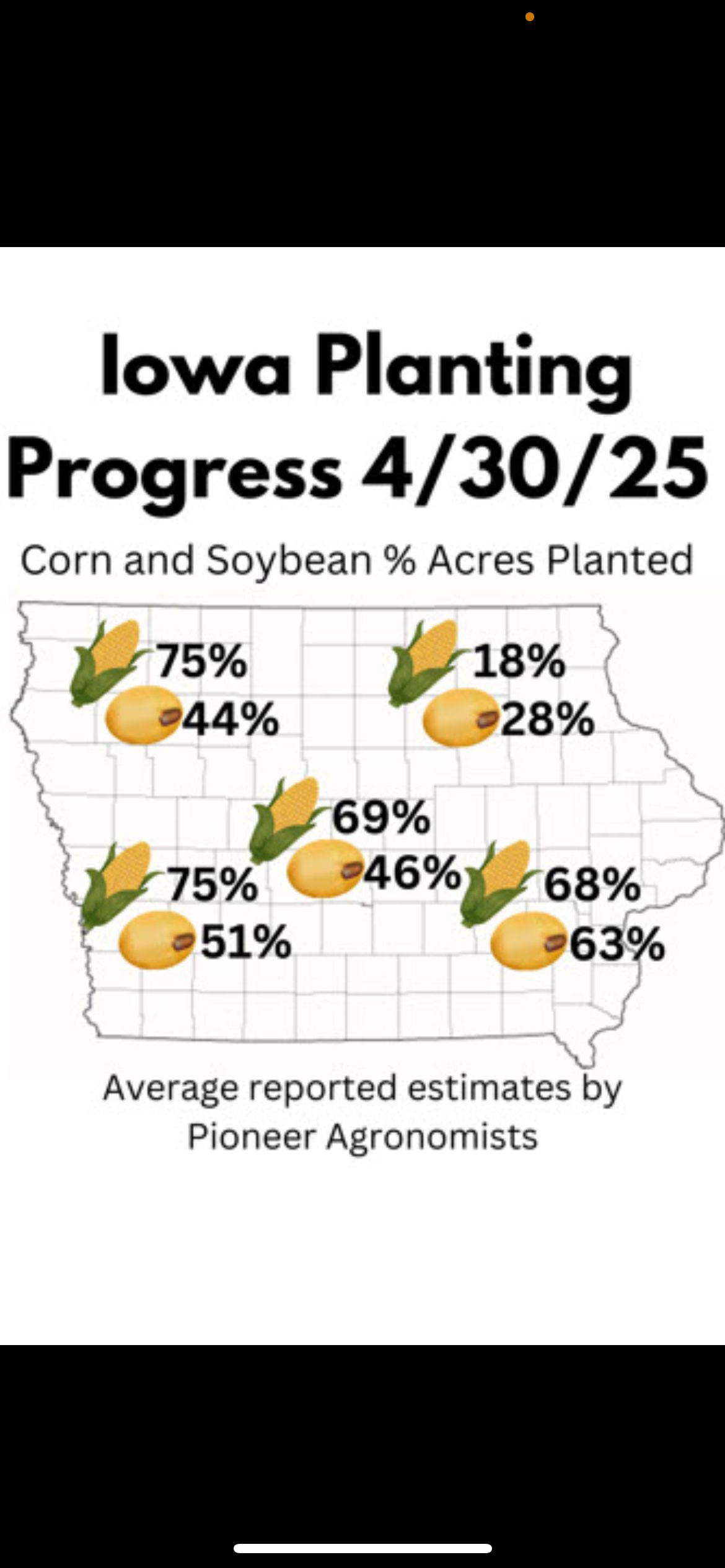

As of May 8, 2025, U.S. corn planting has reached approximately 46% completion, up from 40% last week and slightly ahead of the five-year average of 43%. In the Midwest, progress varies significantly by state. Illinois, a cornerstone of corn production, is at 38% planted, trailing its five-year average of 48% due to wet conditions in southern and central regions slowing fieldwork. Iowa reports 42% planted, about 3% behind its typical pace, while Nebraska and South Dakota are surging ahead. South Dakota saw a 14% week-over-week increase, and Nebraska’s drier soils have facilitated rapid planting, reaching 50% completion, ahead of its five-year average of 46%. Nationally, 15% of corn has emerged, matching last year’s pace and surpassing the five-year average of 12%.

Regional challenges persist. Excessive moisture in the Eastern Corn Belt, particularly Illinois and eastern Iowa, has delayed planting windows, while drier conditions in the Western Corn Belt have accelerated progress. Larger Midwest farms, which dominate corn production, are increasingly relying on precision agriculture tools from companies like Ag Leader and Precision Planting to optimize planting efficiency. While exact adoption rates for these brands are unavailable, a 2023 USDA report notes that 27% of U.S. farms use precision agriculture practices, with adoption rates nearing 70% among large-scale crop producers.

Soybean Planting Progress

Soybean planting is gaining momentum, with 35% of the U.S. crop planted as of May 8, up from 30% last week and ahead of the five-year average of 28%. Illinois soybeans are at 37% planted, closely aligning with the state’s five-year average of 38%. Iowa reports 34% planted, slightly ahead of its typical pace, while South Dakota and Nebraska are progressing rapidly, with South Dakota up 12% week-over-week and Nebraska at 40% planted. Nationally, 10% of soybeans have emerged, on par with last year and ahead of the five-year average of 7%. Louisiana continues to lead, with planting 28% ahead of its historical average. Favorable soil conditions in drier regions like Nebraska and South Dakota have supported soybean planting, though wet fields in parts of Illinois and eastern Iowa remain a hurdle.

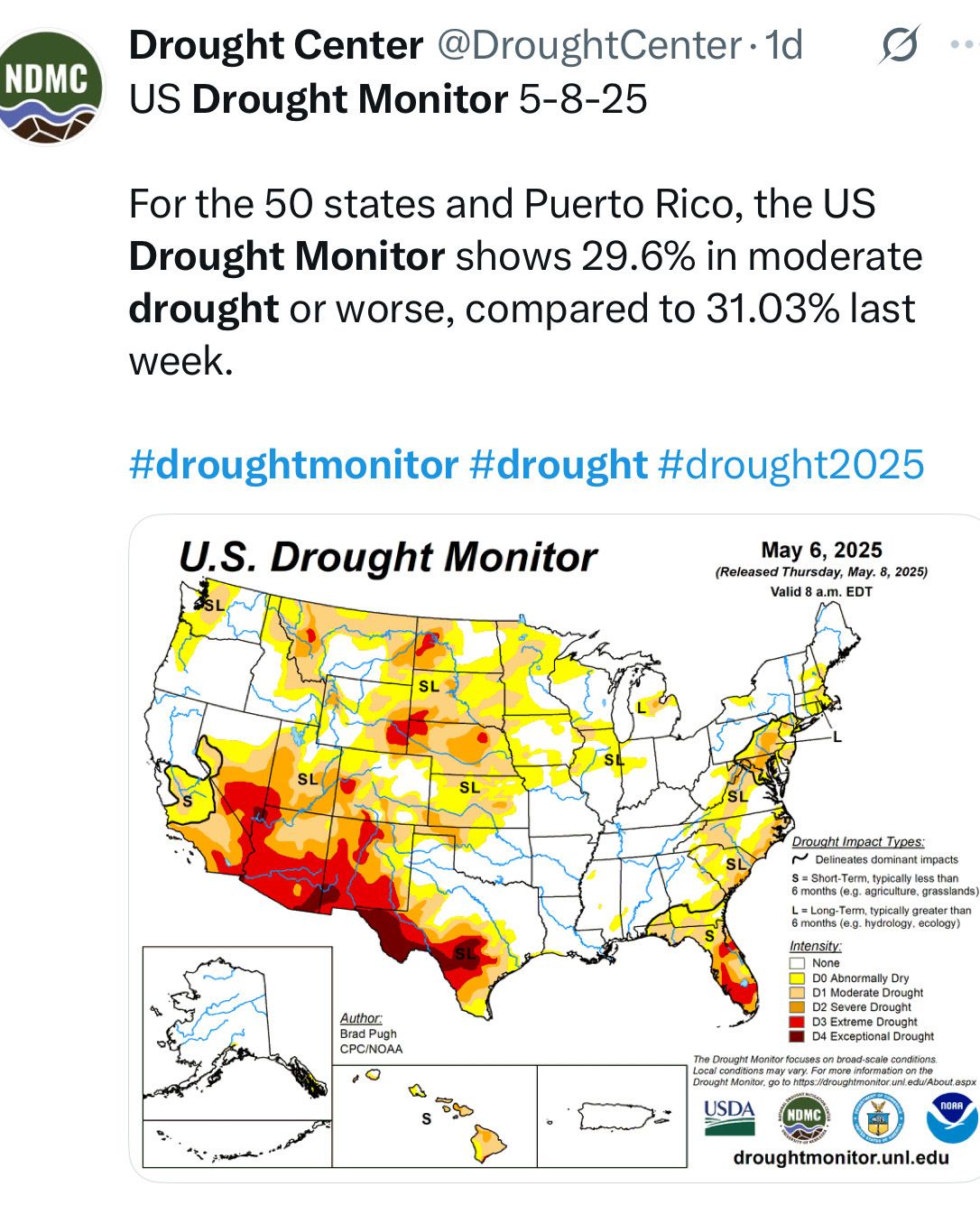

Drought Monitor Insights

Drought conditions, tracked by the U.S. Drought Monitor and reported by GrainStats and the National Drought Mitigation Center, continue to influence the 2025 planting season. As of May 6, 2025, 24% of U.S. corn production areas are affected by drought, down from 26% two weeks ago and a significant improvement from 60% in early March, thanks to spring precipitation across much of the Midwest. This figure remains slightly above the five-year average of 22.8%.

In the Midwest, drought impacts vary. Nebraska reports 7% of its land under extreme drought (D3), concentrated in the northwest, with topsoil moisture rated 25% very short and subsoil moisture 34% very short. These conditions could complicate corn and soybean establishment if rainfall remains scarce. Iowa, by contrast, benefits from improved moisture, with topsoil rated 70% adequate and only 3% very short, supporting planting efforts. Illinois shows minimal drought, with just 6% of the state abnormally dry and no moderate drought reported. Kansas, however, faces deteriorating conditions, with 18% of the state under extreme drought and 81% abnormally dry or worse, posing risks for early crop development.

The National Drought Mitigation Center notes that while recent rains have eased drought in many Midwest states, long-term hydrological concerns—such as low streamflows and groundwater levels—persist in western Iowa, southern Missouri, and parts of Kansas. The USDA’s Ag in Drought report warns that subsoil moisture deficits could hinder crop emergence in these areas, particularly for corn, which requires consistent moisture during early growth.

Land Ledger Podcast

In a new solo-episode format this week: What can the century-old tractor wars teach today’s AgTech founders about innovation, strategy—and knowing when to let go of the past? In this solo episode of The Land Ledger, host Brian Kearney dives into the book Tractor Wars by Neil Dahlstrom, offering an insightful recap of the early battle for dominance in the agricultural equipment industry. Brian traces the origin stories of three iconic companies—Ford, International Harvester, and John Deere—and unpacks the different strategies each took to shape the future of tractors and ag innovation.

Listen in to hear how International Harvester, once a dominant ag company, missed its moment by clinging to horse-drawn equipment too long, as well as what became Ford's fatal flaw in the ag market. You’ll learn how John Deere employed a slower, more deliberate "infinite game" strategy, what today’s ag entrepreneurs can learn from this history, and more.

Heard on X